pay indiana state estimated taxes online

Pay by check or money order. Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online Services Guest Payment Service directly visiting ACI Payments.

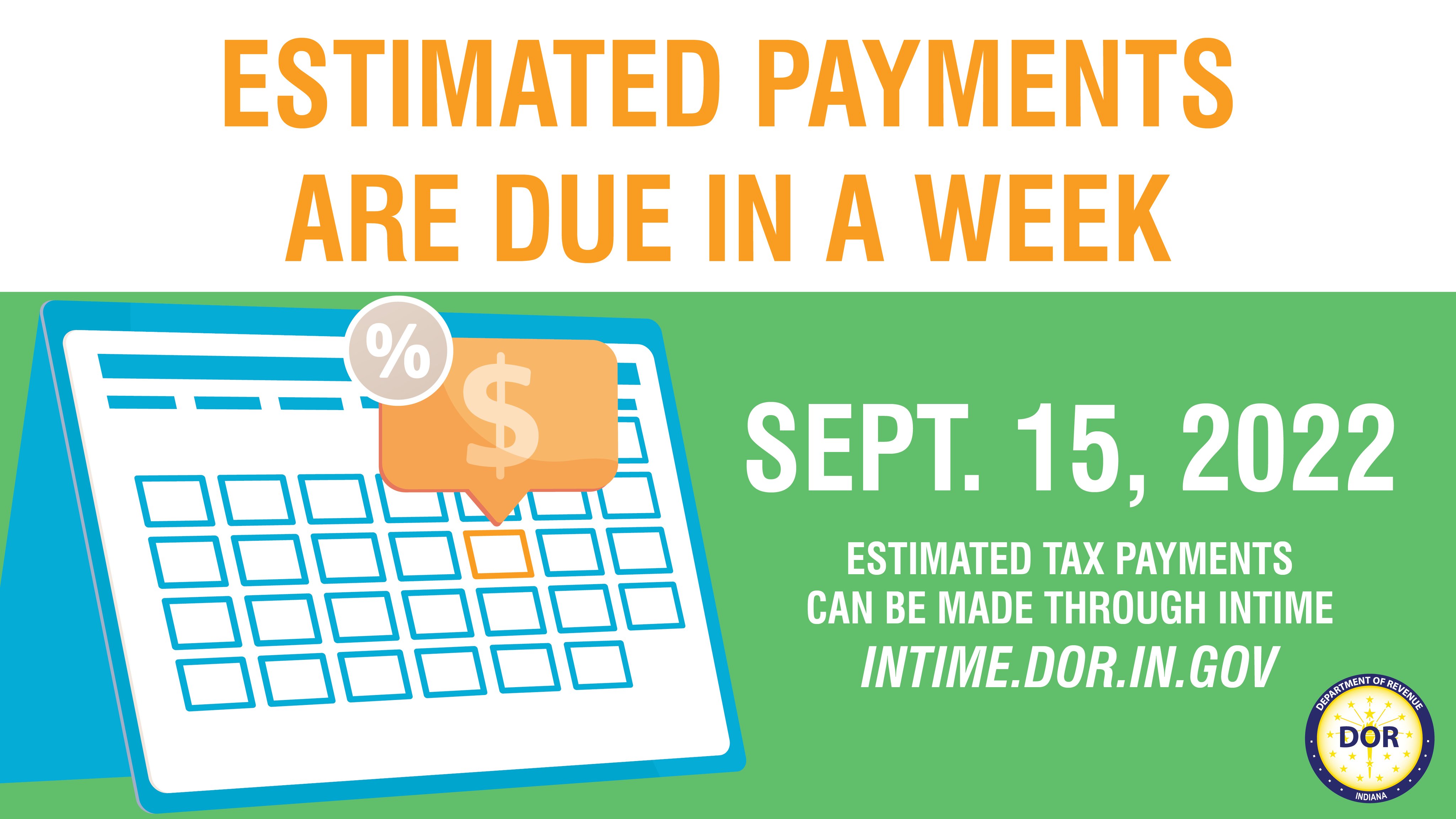

Indiana Dept Of Revenue Inrevenue Twitter

Wheres My Income Tax Refund.

. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Sales Tax 1382. Michigan Estimated Income Tax for Individuals MI-1040ES Michigan Individual Income Tax Extension Form 4.

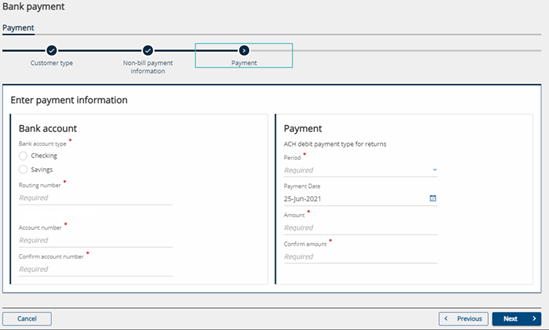

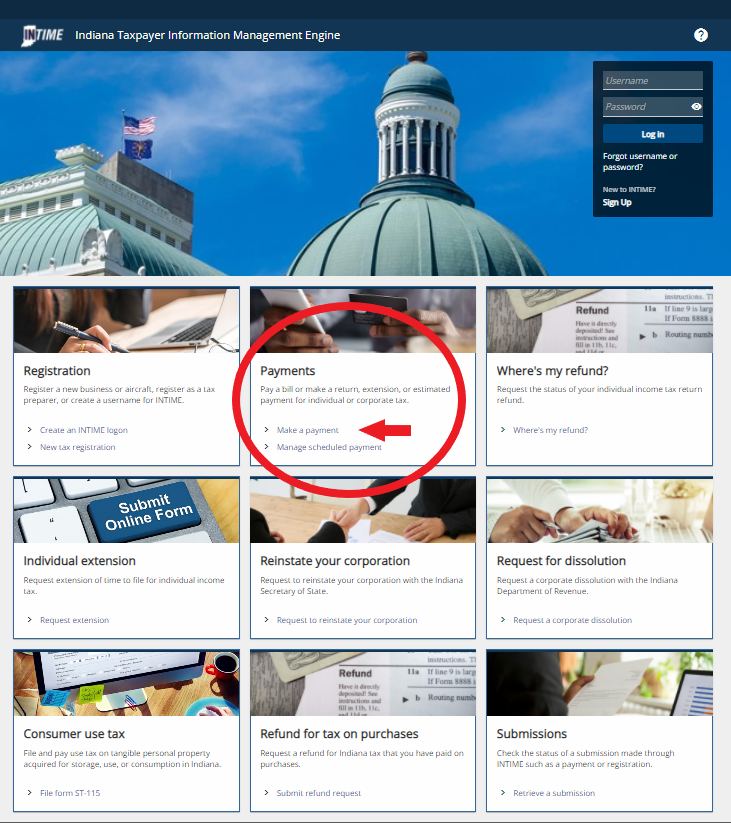

How To Pay Your Taxes With A Credit Card In 2022. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer Information Management Engine INTIME at intimedoringov.

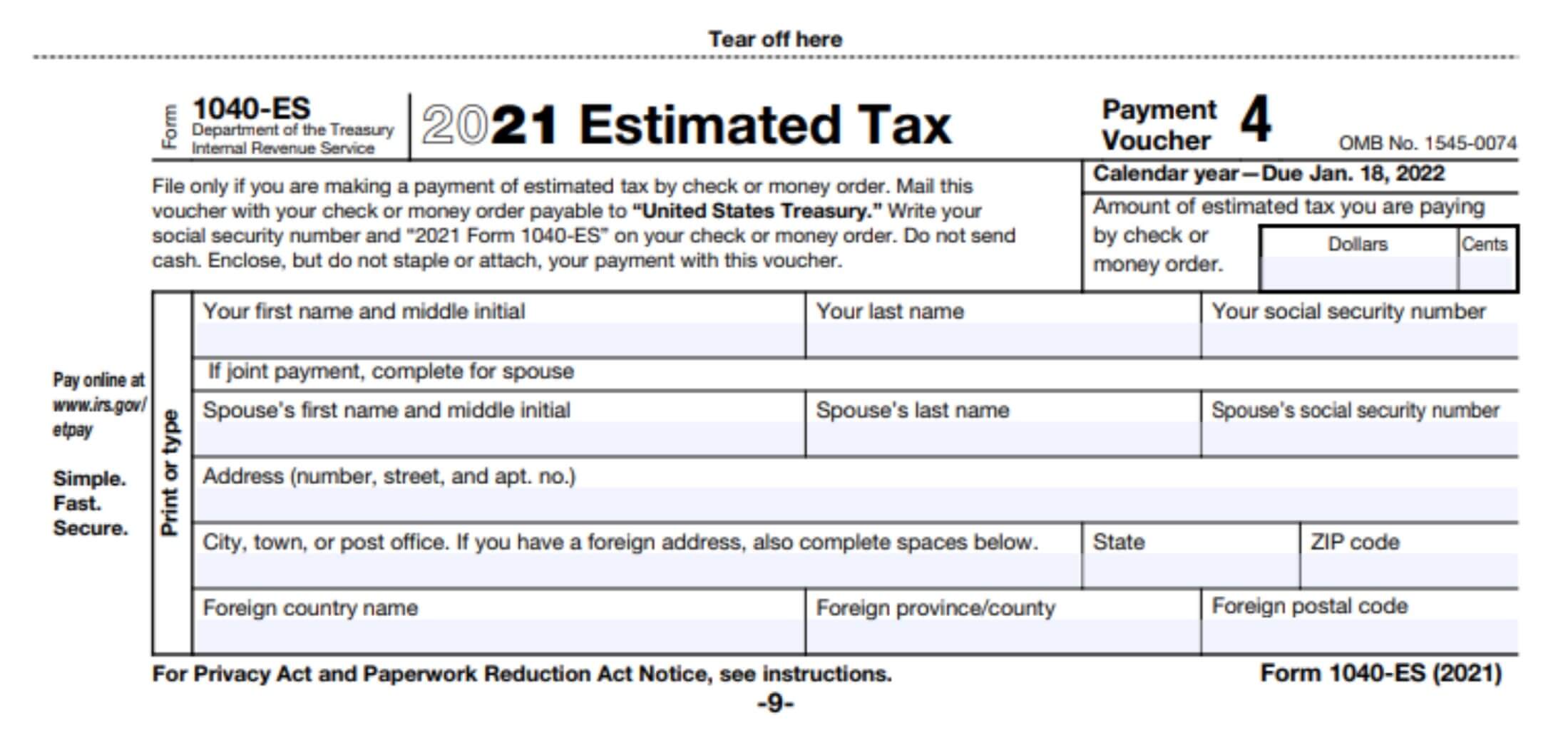

If you do not have your voucher visit our Electronic Payment Vouchers page to create one. Pay your Indiana tax return. You must make estimated payments if the expected tax due on your taxable income not subject to withholding is more.

Access INTIME at intimedoringov. Estimated payments may also be made online through Indianas INTIME website. You will receive a notification from PayConnexion and your bank will.

To make an individual estimated tax payment electronically without logging in to INTIME. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. Percent of income to taxes 31.

DState D EZIP Code E FIndiana County F HTax Year Ending H Month Year If you are remitting a payment with this. The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portalINTIME provides access to manage and pay. If you file your income tax return on paper.

Total Estimated Tax Burden 23164. June 5 2019 250 PM. If the amount on line I also includes estimated county tax enter the portion on.

Use a pre-printed proof of estimated taxes issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated taxes. Personal Income Tax Payment. There are three types of bills.

The Indiana income tax system is a pay-as-you-go system. The estimated income tax payment and Form E-6 and IT-6 are due on. Income and Fiduciary estimated tax payments.

Many taxpayers have enough taxes withheld from their income throughout the year to cover their year-end total tax due. If the amount on line I also includes estimated county tax enter the portion on. Created with Highcharts 607.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Select the Make a Payment link under the.

Know when I will receive my tax refund. Check status of payment. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Tax Payment Solution TPS - Register for EFT payments. Find Indiana tax forms. If you owe 1000 or more in state and county tax for the year thats not covered by.

We last updated the Estimated. Property TaxRent Rebate Status. To pay an estimated payment or an extension payment for your Corporation Income Tax andor Limited Liability Entity Tax LLET.

If the amount on line I also includes estimated county tax enter the portion on. Make a payment plan payment.

Fillable Online In State Of Indiana Quarterly Premium Tax Form Fax Email Print Pdffiller

Indiana Dept Of Revenue Inrevenue Twitter

Form Urt 1 Fillable Current Year Indiana Utility Receipts Tax Return And Schedule Urt 2220

Llc Tax Calculator Definitive Small Business Tax Estimator

Indiana Income Tax Calculator Smartasset

Who Should File Irs Form 1040 Es

Guide And Calculator 2022 Indiana Sales Tax Taxjar

Quarterly Tax Calculator Calculate Estimated Taxes

Dor How To Make A Payment For Individual State Taxes

Indiana Paycheck Calculator Smartasset

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Estimated Tax Payment Due Dates For 2022 Kiplinger

Quarterly Tax Calculator Calculate Estimated Taxes

Indiana Tax Calculator Internal Revenue Code Simplified

Indiana Reports 6 1 Billion Budget Surplus Wthr Com

Dor How To Make A Payment For Individual State Taxes

Owe State Taxes Here Are Your Payment Options Wbiw

How To Do Payroll In Indiana What Every Employer Needs To Know